Our Assets – Overview

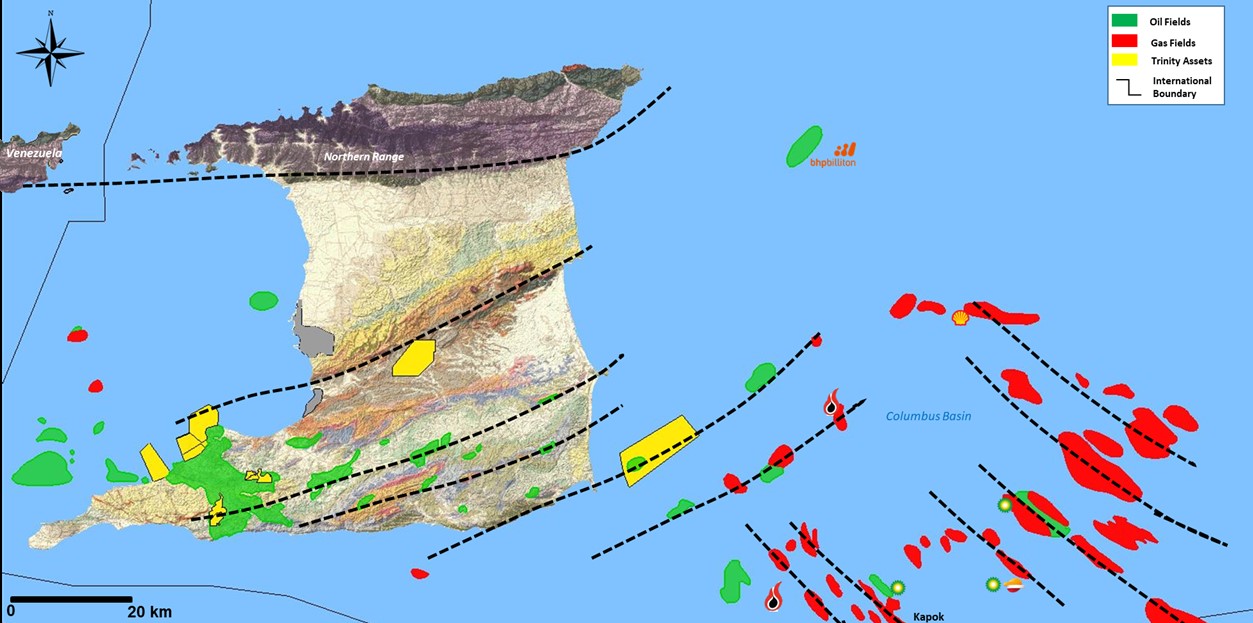

Trinity operates three licences and six sub-licences in Trinidad with assets onshore and offshore the East and West Coasts.

Trinity holds 100% operated working interest across all onshore assets by way of six Lease Operatorship Agreements (LOAs) within the Southern Basin and Central Range and currently operates over 170 producing wells onshore.

East and West Coast assets are operated under licence agreements with the Ministry of Energy and Energy Industries, within the Columbus Basin and Gulf of Paria. The 2023 management estimated year end 2P reserves and 2C resources totalled 51.58 mmstb with average production across all assets averaging 2,790 bopd (2023).

Why Trinidad & Tobago?

Stable environment:

Credit rating: Moody’s: Ba1/ S&P:BBB+

Heritage and Stabilisation Fund (HSF): US$ 5.9bn1

Gross Domestic Product (GDP): US$21.9 bn2

GDP per capita: US$ 16,0412

Westminster Style Parliament / English Law

Highly educated & Skilled Workforce

Production:

> 100 years of hydrocarbon production

8th largest exporter of liquefied natural gas (LNG) in the world3

Mature infrastructure for oil and gas operations

Reforming regime to encourage maximising recovery

Players:

Majors in Trinidad include Shell, BP, Woodside and Repsol

Independents include privates such as Perenco and DeNovo as well as listed operators such as EOG, Touchstone and Challenger

Sophisticated local and international oilfield supply chain (e.g. Schlumberger, Halliburton, Tucker Energy, Baker Hughes, Wood Group, Worsley Parsons etc).

Fiscal Terms:

Petroleum Profits Tax (PPT) – 50% of chargeable profits

Supplemental Petroleum Tax (SPT) – Onshore: 18% / Offshore: 26.4%* of net revenues for realised prices above US$ 50.0/bbl (under watch for reform)

1. Heritage and Stabilisation Fund: HSF Quarterly Report Dec 2017,

2. GDP/ GDP per capita (2016): World Bank Data Centre,

3. LNG exporting countries: www.statista.com

*Net of sustainability incentives (20%)